Planning to travel to South Korea soon but not sure what’s the best way to pay for goods and services in Seoul and beyond? Want to avoid expensive money exchange costs when you arrive in Korea? The issue of how to pay in Korea, whether you should use cash, card, or some other payment means, is a common problem for travellers and one I hope to resolve in this article.

This article will cover the most popular methods of payment, like cash and credit cards, as well as other methods, such as mobile payment apps, Korean debit cards, and transportation cards. From street food to shopping, sightseeing, and singing rooms, spending money in Korea doesn’t need to be difficult.

I’ve lived and travelled in Korea since 2015 and helped hundreds of people plan their trip to Korea through this website and social media groups. I want to share all of my best tips to help you save money, avoid problems, shop, and spend in Korea more easily and to help you plan your Korean adventure.

Affiliate Disclaimer: This site contains affiliate links and I may earn commission for purchases made after clicking these links.

Cash Or Card: What’s The Best Way To Pay In Korea?

Which is better, cash or card when you want to pay in Korea? Well, it depends on a number of factors, such as what you’re buying, where you’re buying it from, and which country you’re visiting from. You might use cash to pay for small purchases in stores, traditional markets, or for street food, but as all merchants in Korea are required to accept credit cards by law, the need for cash is shrinking.

Using a credit card is the best payment method in Korea and will allow you to pay safely and conveniently for tours, hotels, meals, coffee, and more. Visa and Mastercard are accepted widely for payments in Korea from small purchases in shops to large payments like hotels and tours. However, using a foreign credit card isn’t 100% reliable for payments, so taking cash is a good backup.

Korea is fast becoming a cash-free society with a strong push for digital payments through apps, as well as the use of credit cards and mobile payments. Public transport has long rewarded travellers who don’t use cash with discounted fares available through transportation cards. These days, many buses are cash-free and won’t accept cash in cities like Seoul (20% of buses) and Daejeon (all buses).

If you don’t want to pay with your credit card when travelling in Korea, an alternative is a multi-currency travel card, such as those offered by Wise and Revolut, as well as payment apps such as Apple Pay and Samsung Pay. These are becoming more common as a means to spend money when visiting Korea and a way to possibly save money vs. exchanging cash.

Recommended Money Mix For Visiting Korea

What payment options would I recommend for Korea? From my own experience of travelling abroad for over 20 years, I recommend a mixture of cash and card, as well as paying for as much as you can before travelling so you can pay in your home currency. Booking hotels, tours, and attractions through sites like Klook.com can potentially save you money and avoid exchange fees.

Here’s a suggested money mix for visiting Korea:

- Bring 20-30% of your budget in cash (Korean won or your own currency).

- You can withdraw extra cash using a credit card or multi-currency card if you need to.

- Bring a credit card or multi-currency card for the other 70-80% of expenses.

- Alternatively, get a WOWPASS when you arrive in Korea and bring more cash to top it up.

- Book as much as possible online before you travel.

- Online prices for attractions are generally much cheaper than the gate prices.

Despite Korea being card-friendly, there are still times when you need cash, so definitely bring some with you or withdraw it from a Global ATM in Korea. I suggest using a card for most of your spending as it’s quick, convenient, and increasingly the only option due to Korea’s move away from using cash.

Which card you bring depends on what you’re comfortable using. I travel using a Wise multi-currency card to make payments and receive money in Korea from my own account and other sources. When I travel to other countries in Asia, such as Thailand, I don’t use my UK credit card as my bank charges me an exchange fee. It’s much cheaper for me to transfer money to my Wise card instead.

Another option that I would recommend to travellers, especially those from other parts of Asia, is bringing cash and loading it onto a WOWPASS, which is a Korean debit card. The WOWPASS allows you to exchange money from 15 foreign currencies into Korean won and load it onto the debit card, which you can use to pay across Korea.

I’ll cover each of the payment methods discussed above in the following sections so you can get a better idea of the pros and cons of each and whether it’s the right way for you or not.

Disclaimer: This guide is intended to provide you information about payment options in Korea and the practicality of using each. I don’t think there is one payment option that is suitable for all travellers and I recommend you look at your own situation and determine what’s best for you based on exchange fees from your country, fees charged by your bank, and whether your credit card works overseas.

Paying By Debit And Credit Card In Korea

Credit cards from Visa and Mastercard are widely accepted in Korea and will work in most locations, including tourist attractions, hotels, shops, department stores, and restaurants. American Express is also accepted, but not as widely. Using your credit card in Korea can be a great way to build up points / miles and your card may have other benefits, such as travel insurance.

While larger businesses are likely to accept foreign credit cards, you might find that smaller ones refuse to accept them or are unable to process them, which is why I recommend bringing some cash or getting a Korean debit card just in case. However, in most places, especially in tourist-friendly places like Seoul, Busan, and Gyeongju, international credit cards should be accepted without any problems.

Here are some considerations when deciding whether you should pay by credit card in Korea:

Foreign Exchange Fees: Your bank may charge you a fee when you use your credit card overseas. Be sure to check with your bank before travelling so you don’t find unexpected costs when you return.

ATMs: Foreign credit cards should work at ‘Global ATMs’ in popular tourist areas like Myeongdong, Hongdae, and Gangnam, as well as at Incheon Airport. However, other ATMs in Korea may not accept non-Korean credit cards. There is usually a fee to use a Korean ATM of around ₩3,600 (about $3). Also, Korean ATMs don’t operate 24 hours a day and close around 11pm at night.

Chip & Pin Use: Card payments in Korea are done by touching the card to a card reader or inserting the card and signing for the payment if it’s over ₩50,000. Chip & Pin isn’t commonly used in Korea.

Blocked Cards: Your bank may block your credit card when travelling as a security measure. It might be necessary to tell your bank that you plan to travel to Korea so they don’t block it later on.

Fraud & Card Security: Credit card fraud against tourists in Korea isn’t a serious issue, although it can still happen. Phishing is a growing problem in Korea, but usually against Koreans instead of tourists.

Pay Before You Travel: You can book tours, hotels, attractions, and lots more online before you travel and pay with your credit card. These will charge you in your own currency, so there’s no exchange rate fees and you also have peace of mind that everything is booked before you arrive in Korea.

Debit Cards: If your debit card is from Visa, Mastercard, or American Express, you should be fine using it to pay in Korea in the same way you can a credit card, as long as your bank allows it. However, the same issues will apply when trying to withdraw money from an ATM – you’ll need to go to a ‘Global ATM’ to withdraw cash. Also, you’ll need to check if your bank allows you to use it internationally.

| Advantages | Disadvantages |

|---|---|

| Convenient | May be rejected |

| Used in many locations | Hidden exchange fees |

| Faster than using cash | May be blocked |

| Credit card perks (points, etc) | Might not be accepted by small businesses |

| Can be replaced if lost | |

| Covers emergency expenses |

Multi-Currency Cards: Wise And Revolut

I know many travellers feel comfortable using their own credit card due to the various benefits their credit card might offer, but there is another way to pay in Korea that could lower the fees you pay. This alternative is a multi-currency travel card, which allows you to convert money from your home currency to Korean won online and then use that balance to pay by card in Korea.

There are many companies that offer multi-currency travel cards, including Wise and Revolut, which are available to residents of the USA, Canada, UK, Europe, Australia, New Zealand, Singapore, and many other countries. Starling Bank (UK), YouTrip (Singapore), Chime (US), N26 (Eurozone), and KOHO (Canada) also provide multiple-currency travel cards.

The main benefits of these cards can include:

- Top-up from your home bank account.

- Only spend what you need.

- No transaction fees when you pay by card.*

- You get the mid-market exchange rate.*

- Withdraw cash from ATMs.

- Track your spending with the app.

- Instantly freeze and replace your card.

- Digital payments through Google / Apple Pay*

- Can be used in dozens of countries.*

*depending on the card and the terms and conditions of that card

What’s good about these cards? Multi-currency cards offer a lot of flexibility and cost savings when travelling as you can get the mid-market exchange rate on currency exchanges, which is typically better than the rates offered by money exchanges. It’s easy to control your spending in the connected app and you can transfer more money to the card when you need it. Any leftover money can be refunded, saved for later, or converted into another currency. You can also use them in other countries.

How do these cards let you pay in Korea? The process is really simple. First, apply for the card before you travel and download the relevant app that goes with it. Transfer money from your bank to top-up the card balance in your home currency and then convert that into Korean won (or other currencies you might need). When you arrive in Korea, use the card as you would a regular credit card.

My experience using Wise in Korea: I’ve tested out both the Wise card and Revolut card in Korea and they both worked with no real problems. I tested them in restaurants, shops, cafes, attractions, and other places tourists are likely to visit. The only time they didn’t work was at an automated kiosk for train tickets in Seoul Station. I use the Wise card to spend my UK money in Korea or when I travel.

Learn more: This article about using Wise in Korea shows you how to get a Wise card, how it can save you money as you travel (in many countries), how to activate the card in Korea, and lots more.

WOWPASS Korean Debit Card

An alternative to using your own credit card to pay in Korea is to get a local Korean debit card called the WOWPASS. The WOWPASS has two great functions that make it a practical solution for travellers to Korea, especially those from countries such as the Philippines, Indonesia, Malaysia, and Thailand.

Debit Card Function: The main feature of the WOWPASS is the ability to pay like a local in Korea with a debit card issued by a Korean company, which is accepted in most locations. You can exchange 15 currencies, including PHP, IDR, MYR, THB, into Korean won to top-up the debit card (up to a value of 1 million won) at the WOWPASS terminals found across Korea. This helps you to avoid exchanging cash elsewhere and you can withdraw cash from the card in Korean won, too.

T-Money Function: The WOWPASS comes with a built in T-Money transportation card, which means you can use it to travel on Korea’s buses and subways. This makes it really easy to travel around Korea and you can simply touch in and out of buses and subways as you travel and the fee will be automatically deducted.

My experience using WOWPASS in Korea: I wrote an article about the WOWPASS and tried using the card in loads of locations in Seoul, Incheon Airport, and Daejeon. It’s very easy to use and the app helps you find the WOWPASS machines where you can recharge the card and exchange money. I still use the card now and I would definitely recommend it as an option for people visiting Korea.

Learn more: Read my guide to the WOWPASS to see how to get one, where it works, how to top it up, ways it can save you money, and my experience using the WOWPASS in Korea.

Planning to visit Korea? These travel essentials will help you plan your trip, get the best deals, and save you time and money before and during your Korean adventure.

Visas & K-ETA: Some travellers to Korea need a Tourist Visa, but most can travel with a Korean Electronic Travel Authorisation (K-ETA). Currently 22 Countries don’t need either one.

How To Stay Connected: Pre-order a Korean Sim Card or a WiFi Router to collect on-arrival at Incheon Airport (desks open 24-hours). Alternatively, download a Korean eSIM for you travels.

Where To Stay: For Seoul, I recommend Myeongdong (convenient), Hongdae (cool culture) or Gangnam (shopping). For Busan, Haeundae (Beach) or Seomyeon (Downtown).

Incheon Airport To Seoul: Take the Airport Express (AREX) to Seoul Station or a Limo Bus across Seoul. Book an Incheon Airport Private Transfer and relax to or from the airport.

Korean Tour Operators: Tour companies that have a big presence in Korea include Klook, Trazy, Viator, and Get Your Guide. These sites offer discounted entry tickets for top attractions

Seoul City Passes: Visit Seoul’s top attractions for free with a Discover Seoul Pass or Go City Seoul Pass. These passes are great for families and couples visiting Seoul – you can save lots.

How To Get Around: For public transport, grab a T-Money Card. Save money on Korea’s high speed trains with a Korea Rail Pass. To see more of Korea, there are many Rental Car Options.

Travel Money: Use money exchanges near Myeongdong and Hongdae subway stations for the best exchange rates. Order a Wise Card or WOWPASS to pay by card across Korea.

Flights To Korea: I use flight comparison sites such as Expedia and Skyscanner to find the best flights to Korea from any country. Air Asia is a good option for budget flights from Asia.

How To Learn Korean: The language course from 90 Day Korean or Korean Class 101 both have well-structured lessons and lots of useful resources to help you learn Korean.

Cash And Traveller’s Cheques

South Korea’s currency is called the Korean won (₩) and comes in ₩1,000, ₩5,000 ₩10,000 and ₩50,000 notes as well as coins in ₩1, ₩5, ₩10, ₩50, ₩100, and ₩500 denominations. The value of the Korean won can be confusing to travellers from countries where the numbers of the currency are much smaller, such as in the USA, Europe, and the UK.

To understand the value of Korean money, I find it easier to remember what each one will buy you in Korea. A bottle of water costs around ₩1,000, a coffee costs about ₩5,000, a Korean meal costs around ₩10,000, and a budget to mid-range hotel costs about ₩100,000 per night, depending on the season and location.

Paying with cash in Korea is becoming more difficult as restaurants, supermarkets, public transportation, and attractions are moving towards automated kiosks that only accept card or digital payments. However, you will need some cash to pay to top-up transportation cards, such as the T-Money card, which is why it’s useful to have cash before you travel.

Cash is still important and it will certainly be useful to carry it with you as you explore Korea’s markets and food stalls, which should be happy to accept cash. However, as a tipping culture doesn’t exist in Korea, you don’t really need to worry about keeping small bills with you to leave tips. Koreans won’t expect tips in almost all situations.

Where To Exchange Money In Korea

The best place to convert your foreign currency into Korean won is at a money exchange in Seoul, especially in popular tourist areas such as Hongdae and Myeongdong. The aforementioned WOWPASS machines are also great for converting foreign currency into Korean won (to pay by debit card) and both rates are better than airport exchange rates.

As research for this article, I visited money exchanges in Myeongdong, Hongdae, and Incheon Airport, as well as checking the rates given at WOWPASS machines. Overall, the rates were worst at the airport and best with WOWPASS. Here are the rates offered on this specific day (June 29th, 2023) for converting USD to KRW:

- Airport exchange rate: $1 = ₩1,249.00

- Seoul money exchange: $1 = ₩1,287.80

- WOWPASS exchange rate: $1 = ₩1,302.81

Potential savings with Seoul exchanges: If you were to exchange $500, the difference between the airport exchange rate and the WOWPASS exchange machine is ₩26,905 (roughly $20). Depending on your budget, this might not be enough of an incentive to wait to find a money exchange in Seoul instead of changing money at the airport, but if you want to cut costs, there are cheaper options available.

There are money exchanges near subway stations in Myeongdong and Hongdae where you can get competitive exchange rates in Seoul. WOWPASS exchange machines are located across Seoul.

Which currencies can be converted in Korea? Foreign currencies that can be converted into Korean won at the airport and in money exchange machines typically include USD, JPY, EUR, VND, CNY, THB, PHP, AUD, GBP, CHF, SGD, NZD, CAD, HKD, and TWD. WOWPASS exchange machines also accept MYR and IDR.

Global And Local ATMs In Korea

You can withdraw cash from ATMs in Korea using a debit card, but not all ATMs will accept international cards. Look for a sign saying ‘Global ATM’ or ‘Foreign Currency ATM’ to withdraw cash in Korea, like those pictured above which are located in Hongik University Station in Hongdae. You can also withdraw cash using a credit card, but it might be more expensive due to cash advance fees.

ATM fees: Whether you use a debit or credit card, an ATM is likely to charge a fee to withdraw money using a foreign card. The last time I withdrew cash using a foreign card at a Korean ATM, the fee was ₩3,600 (about $3). Your bank or credit card company may also charge a fee on top of that or give you a bad exchange rate when converting from KRW. These costs can add up a lot if you withdraw regularly, so try to make fewer withdrawals.

Where to find Global ATMs: You can find Global ATMs in popular tourist destinations such as Incheon Airport, Myeongdong, Hongdae, Gangnam, and Jamsil.

Are Traveller’s Cheques Accepted In Korea?

Yes, traveller’s cheques can be exchanged at Korean banks or currency exchange offices in Korea. You might also be able to exchange them at certain hotels. I haven’t used traveller’s cheques in Korea so can’t say how easy it is to exchange them, but large banks in central Seoul are probably your best option. You can ask at your hotel, too.

Currency Restrictions For South Korea

If you plan to bring cash to Korea and exchange it into Korean won, or even if you’re bringing Korean won, please note that there is a limit of $10,000 USD that can be legally brought into the country. This figure includes travellers cheques. The limit of $10,000 can be exceeded, but you must report it to customs when you arrive.

Korean Public Transportation Cards

If you want to travel on Korea’s excellent public transportation network, then you should pick up a transportation card when you arrive at Incheon Airport or from other locations across the country. The best part about these cards is that they not only allow you to pay for transport in Seoul, you can use them for the whole country and to pay for small purchases, too. Some even give discounts.

Here’s a breakdown of the main transportation cards in Korea and where to buy them:

- T-Money Card: This is the most popular transportation card and can be used on buses and subways, as well as to pay for items in shops, cafes, vending machines, and even tickets for attractions. These cards are available from convenience stores nationwide and come included with the WOWPASS.

- Korea Tour Card: This is a tourist-only transportation card that can be bought at airports and harbours in Korea. It uses the T-Money system to pay for public transport and make payments. You can also get certain discounts when you show this card.

- Cashbee Card: The Cashbee Card by Lotte can be purchased and used in most of the same locations as T-Money. You can purchase a Cashbee Card at convenience stores and subway stations across Korea.

- Rail + Card: The Rail+ Card is sold at train stations across Korea and is run by the national train network. You can use it to pay for train services, including Korea’s high-speed KTX trains, which the other cards can’t.

- Namane Card: The Namane Card by KB Bank uses the Rail+ Card system and can be used in the same locations. However, this card allows you to create personalised card designs.

- Creatrip X Bellygom Card: The Creatrip X Bellygom transportation card is a travel card from Creatrip and features a popular character from YouTube, Bellygom.

Price differences: These cards all cost around ₩3,000 to ₩10,000 for the card, depending on where you buy it, what features it comes with, and whether it has a personalised design or not.

Benefits of transportation cards: These cards offer discounted rates on bus and subway fares (varies by city) and allows you to travel cash-free and conveniently.

Learn more: I’ve written about Korean transportation cards a lot as they’re really useful for travellers coming to Korea. Two of my favourites are the Korea Tour Card, which is a tourist-only transportation card, and the T-Money Card, which is the most popular transportation card used in Korea.

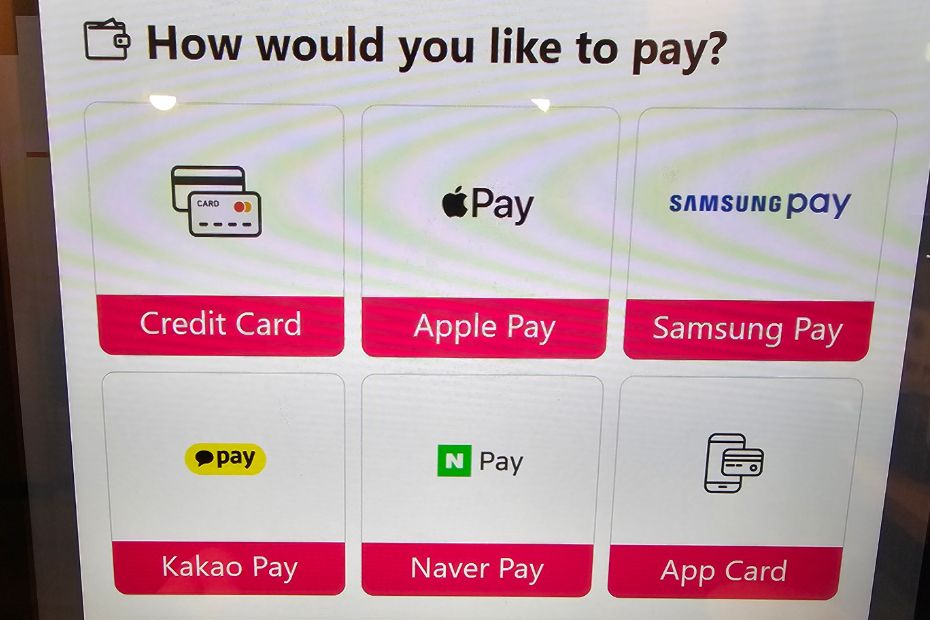

Apple Pay And Samsung Pay

Apple Pay has been available in Korea from March 2023 and can be used in locations that come equipped with NFC enabled payment terminals. There are over 100,000 shops that have NFC terminals in Korea right now, but that number is growing since Apple Pay’s introduction.

Samsung Pay can be used widely in Korea as it doesn’t require NFC terminals to operate and so Korean establishments didn’t bother to install them. Korea is home to Samsung and its payment options have been widely integrated into the Korean payments system.

Can you use Apple Pay or Samsung Pay in Korea? Yes, you can pay with Apple Pay and Samsung Pay if you’ve registered a credit card to either service in your home country.

Will I pay a fee to use Apple Pay? Apple won’t charge a fee to use Apple Pay internationally, but the credit card that you’ve registered with Apple Pay may charge you. If your credit card doesn’t charge a fee to make payments when travelling, then you shouldn’t have any problems paying with Apple Pay in Korea. The same applies to Samsung Pay.

What exchange rate does Apple Pay use? Apple’s exchange rate is whatever rate the credit card issuer is using. The same applies to Samsung Pay. The Wise multi-currency card, in comparison, uses the mid-market rate, which could give you a better rate when you pay in Korea.

What places in Korea accept Apple Pay? It is mostly small and medium sized businesses that have embraced Apple Pay in Korea, such as cafes, restaurants, convenience stores, and shops. Online apps such as Baedal Minjok (food delivery) accepts Apple Pay, but only with Apple Pay accounts registered with a Korean credit card. Samsung Pay is accepted much more widely across Korea.

Korean Mobile Payment Apps

Korea is one of the world leaders in mobile payment apps, which allow you to use your smartphone to make payments as if you’re using a credit card, both online and offline. These are really useful services for foreigners living in Korea and I use Kakao Pay regularly to book train tickets, send money to friends, pay for food deliveries, and more.

Can tourists use Korean mobile payments? Unfortunately, apps such as Naver Pay, Kakao Pay, and Payco, require a Korean phone number and Korean bank account for you to register due to tough banking rules in Korea. The other issue is that these services usually require some Korean language skills to use. Therefore, these aren’t really options for short term travellers in Korea and although they’re useful, I wouldn’t recommend trying to use them.

Learn more: Even if you can’t use Kakao Pay to pay in Korea, you can use services like Kakao talk and Kakao Taxi by creating a Kakao account. This article about Kakao Taxi will show you how to do that.

Problems Paying In Korea

As mentioned, travellers may have some problems when they try to pay in Korea due to certain Korean regulations and policies, especially the no-cash buses and automated kiosks that are increasingly common these days. Here are a few issues tourists to Korea might have regarding making payments.

Online payments: Spending money online in Korea as a foreigner, even when you live here, is frankly a hassle and one that can cause real headaches. Korea has a lot of regulations about online payments, including security checks where you have to provide a Korean phone number to prove your identity to make a payment. Not to mention everything is done in Korean, too.

Most of the time only Korean bank accounts or mobile payments are accepted (which require a Korean bank account) for online transactions in Korea and those are a problem for foreigners even when you have a Korean account and live in Korea. Booking flights using my Korean bank card has been so difficult that I usually end up using my UK card instead and going through a non-Korean website.

Automated kiosks: I see automated kiosks appearing in more and more places these days, including popular attractions like Gyeongbokgung Palace in Seoul. They’re also prevalent in cafes and chain restaurants as it saves money on staff (don’t get me started on the robot waiters!). These machines mostly don’t accept cash payments. Fortunately, they usually come with multiple language options.

Non-staffed convenience stores: Another trend that has been growing, but isn’t too big yet, is non-staffed convenience stores where you enter by swiping your credit card, pick what you want, scan everything at the checkout, then pay with your credit card. As far as I know, these don’t always accept cash and cards are preferred.

Booking rail travel: Korea has a great rail network that’s really well run, is cheap, and covers a lot of the country. The big downside is that you might have trouble paying for tickets online through the official Korail website – letskorail.com – as all payments require 3D Secure verification. An alternative is to use sites like 12Go to book train tickets in Korea, but you’ll pay a slightly higher price.

Similarly, tourists might have trouble booking train tickets at station ticket machines as they require a Korean debit card, as shown in the image below. You should be able to pay at a ticket office in cash or with a credit card, as long as these tickets offices are available and open.

Tips To Save Money In Korea

Here are a few tips I want to share with you to help you save money when visiting Korea.

- Book attractions and tours online: I know I’ve said it several times before, but it really is a lot cheaper and more convenient as you can guarantee your booking. Especially useful during peak travel times like spring and autumn.

- Get tax back when shopping: Korea has increased the tax-free shopping allowance for travellers to ₩5,000,000 (about $4,000) and it’s really easy to get your tax back when shopping in certain stores. Eligible tax-free shops and department stores offer instant tax refunds (up to ₩1,000,000 per transaction) or you can keep your receipts and get your tax back at Incheon Airport and other departure points.

- Use a transportation card: This is a no-brainer. It’s not only cheaper to pay by transportation card, it’s also a lot more convenient and will save you fishing in your pocket for small change.

- Don’t eat or drink at hotels: Korean hotels are reasonably priced, but I find their food and drink offerings are really expensive and, worse, not that delicious. There are so many great cafes and restaurants you can visit to get a meal in instead and you can eat much better traditional Korean meals instead of Western buffet.

- Take advantage of free things: There are loads of free things to do in Seoul and other places, from walking tours to free attractions and street performances. And if you’re visiting a Korean supermarket or department store, eat your fill of free samples!

- Buy souvenirs from Hongdae or traditional markets: Hongdae has loads of snack shops where you can fill your suitcase with gifts for friends and family back home. Traditional markets also offer lots of interesting souvenirs at lower prices than expensive museum gift shops. Insadong is also good for bargain souvenirs.

Learn more: I’ve a whole article dedicated to money saving tips in Seoul that have ways to help you get more from your travel budget. It includes more details about tax-free shopping, discounts, and special days like Culture Day where attractions are free or discounted.

Frequently Asked Questions

Here are some frequently asked questions you might have about travel money and how to pay in Korea. This information is from my own experience and from research conducted to write this article.

Is tax included in the price in Korea?

The amount shown on prices in Korean shops and in restaurants is typically tax-inclusive, which means you won’t be charged any additional tax or other costs beyond what is shown. This makes it easier to see how much you’ll spend before you get to the checkout.

Where’s the best place to exchange money in Korea?

The best places to exchange money are at money exchanges in tourist areas such as Hongdae and Myeongdong. Alternatively, converting money into Korean won through a WOWPASS exchange machine offers competitive rates and comes with the bonus of allowing you to spend money like a local with a Korean debit card.

Do you need cash to tip in Korea?

You don’t need to tip in Korea and therefore it’s not necessary to carry any cash for tipping. In restaurants, cafes, and hotels, tipping is not expected and can actually be frowned upon as it’s against Korea’s traditional culture.

Are credit cards widely accepted in Korea?

Credit card use is very high in Korea and the use of cash is dropping rapidly. You can use credit cards to pay for around 98% of goods and services in Korea and credit card acceptance is mandatory for merchants in Korea.

Liked This? Pin It For Others

If you enjoyed reading this article, then please share this with your friends on Pinterest.